World Tea Expo 2017

Opportunities for tea: RTD, Millennials, and office services

Charlie Cain, executive partner of brand consulting agency Building Oz, alleged a lack of variety and quality in the US tea market motivated him to bring the German premium tea chain TeaGschwendner to the states.

“If I could bring that kind of quality and variety to America where people are drinking low-quality, commodity rate tea bags, I could change people’s perception of tea,” Cain claimed at the World Tea Expo last week.

RTD tea is growing, but entry is still risky

“There are a lot of small RTD players that are doing very well for themselves, but the numbers are still very small in that space,” Cain said. “It’s still a little bit risky for new entrants to get into that space because of the strength of the entrenched competition.”

Large players like Pepsi’s Gold Leaf and Coca-Cola’s Gold Peak brands dominate the RTD tea market registering 25% and 21% annual growth respectively, because they have the existing distribution, bottling, and marketing capacity to succeed in the market, Cain added.

The growth of premiumization in RTD tea is being offset by declining sales in bagged and loose-leaf tea which started in 2015 and is predicted to persist into the future, according to Cain.

Among the $12bn in annual tea sales, RTD tea represents the bulk of the US market at 50%, while 8% of Americans consume loose-leaf tea. However of that small percentage of loose-leaf tea drinkers, only about 10% of their consumption is loose-leaf tea and 90% is for other types of tea, a 2017 Statista Survey revealed.

Cain said consumers often percieve refrigerated RTD tea as higher quality and some manufacturers are choosing to put their shelf-stable tea in the refrigerated case to take advantage.

Generational shift

“Age is primary predictor of interest in trying new varieties,” Cain added.

Brand loyalty to beverage products drops off significantly below the age of 35 with Millennial consumers twice as likely to try four different kinds of tea, and consumers over the age of 50 twice as likely to drink one kind of tea, according to Building Oz research.

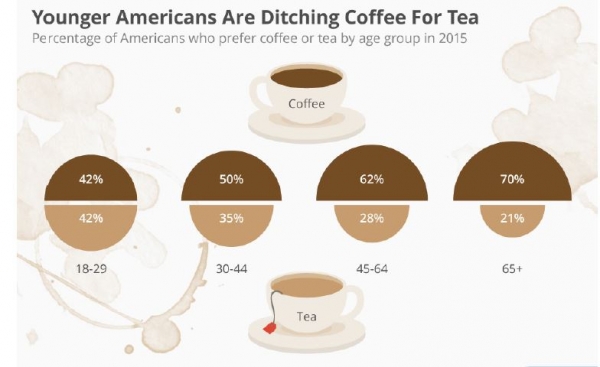

Consumers under 30 years old are also as likely to say tea is their primary beverage as they are coffee. Conversely, 75% of those over the age of 65 say their primary beverage is coffee.

Office coffee and tea services

The office coffee and tea service business is valued at $5bn and growing at a steady clip, according to Building Oz.

The approximately 3.3 million corporate offices in the US are fiscally incentivized to provide coffee and tea services to encourage their employees to stay in the office instead of taking their coffee or tea break at a nearby café, the latter of which costs the company more money due to lost time spent working, Cain said.

“There is so much margin in this space,” he said. “There’s really so much opportunity to build a brand and take advantage of a captive audience.”