Dr Pepper Snapple Group: Ginger ale and sparkling water keeps sales afloat for Q1 2017

DPS saw Canada Dry and Schweppes grow by 5% and 8%, respectively. The company also registered a 1% sales increase for Dr Pepper and Squirt, as well as 5% growth of Peñafiel for Q1 2017.

The gains in some of its carbonated soft drinks brands were offset by declines in the company’s low-calorie TEN portfolio, A&W, and 7UP sodas.

“We outperformed the CSD category and grew both dollar and volume share in IRi measured markets,” DPS president and CEO, Larry Young, said in a statement.

In comparison, Coca-Cola reported a 1% decline in beverage sales for Q1 2017.

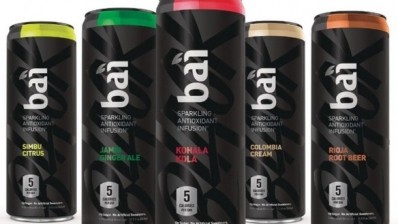

Impact of still drinks and Bai acquisition

Dr Pepper Snapple Group’s non-carbonated beverage portfolio decreased 2% with Snapple leading the declines (-6%) “primarily due to promotional activity timing” and a 2% decline in its Mott’s apple juice brand, according to the company’s quarterly earnings report.

Income from operations declined by 9% ($28m) for the quarter largely due to the acquisition of Bai Brands in January 2017 for $1.7bn.

The addition of Bai to DPS’ portfolio increased volume sales by 1%, but cost the company an additional $41m including $19m in transaction expenses and $11m of marketing investments that included the Bai Super Bowl commercial featuring Justin Timberlake.

However, the company gained $28m in equity from the acquisition and expects Bai to increase its full-year 2017 net sales by 2%, DPS president and CEO, Larry Young, said.

DPS’ growth of allied brands, now excluding Bai, grew 33% due to strong distribution gains in BODYARMOR, Core, and FIJI, the company said.

“Our allied brand strategy continues to be a solid contributor to growth and our continued development of Rapid Continuous Improvement is making us better every day," Young said.