Euromonitor: Global alcoholic drinks market sees slight lift but remains in negative territory

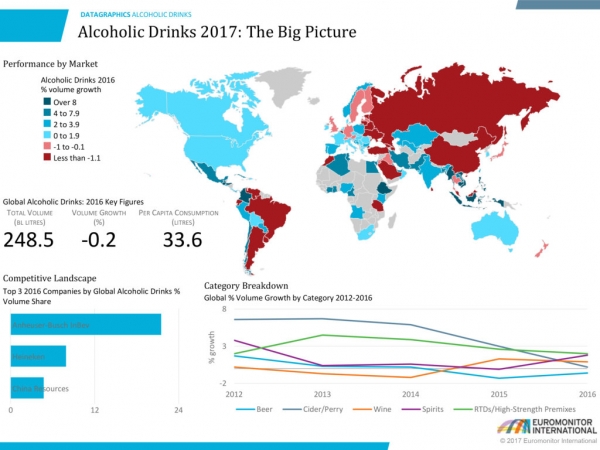

The 0.2% decline was a slight improvement from a 0.8% volume decline in 2015, but still much lower compared to the decade of global volume sales growth experienced prior to 2015.

North and Latin American markets led the slowdown last year.

North American alcoholic drinks volume sales remained stagnant for the year while most of Latin America saw a decline of 1.1%.

“Latin America seems to be slowing down significantly, one of the main reasons there is the Brazilian macroeconomic situation and the political volatility of the country,” Euromonitor senior alcoholic drinks analyst, Spiros Malandrakis, told BeverageDaily.

“Further market consolidation took place in 2016, with leader AB InBev seeing its share of alcoholic drinks rise to 21.5%, mainly through acquiring SABMiller.”

Asia lifts declines

The drop in alcohol volume growth was slightly buoyed by considerably reduced rates of declines in Asia Pacific and Eastern Europe.

“Asia Pacific appeared to escape the depths of its China-led contraction and while regional growth remained stuck in reverse posting a disappointing 0.9% decline for 2016, the pace of the hemorrhaging has indeed halved compared to the previous year,” Malandrakis said.

“Eastern Europe, posting a hefty contraction of 1.5% - which to put into context is in fact the region’s best performance since 2010 - is also appearing to be reaching the end of its deflationary saga.”

While China regains some of the steep declines it experienced two years ago, it still remains the top alcohol drinks market followed by the US and Brazil and is on track to become the largest stout beer market in the world in 2017, surpassing the US and UK.

Nine of the top 10 countries in terms of alcoholic drinks per capita consumption are based in Europe, with the exception of Australia – which ranks eighth, Euromonitor found.

Worldwide premiumization

Global volume sales of alcohol are down mainly due to the dropoff of mainstream alcohol consumption, but the smaller “craft” spirts segment is growing at a faster rate in both developed and emerging markets, according to Malandrakis.

“While the volume narrative seems to have been stalling over the last couple of years, people are certainly premiumizing,” Malandrakis said.

In particular, English gin, tequila, and mezcal have benefited from the premumization trend as consumers in the US and UK embrace artisanal offerings of spirits.