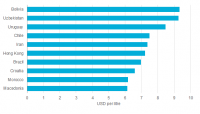

Energy drinks still largely unaffordable for most of the world with Egypt being largest untapped market

The unit price of energy drinks fell by $0.41 per liter between 2011 and 2016, a much steeper decline than the overall soft drinks category.

“The main reason is that energy drinks, long one of the most expensive soft drinks categories, began to filter down the income spectrum to reach a new class of consumers who have the same needs for on-the-go energy to power them through the day as wealthier consumers, but have previously been underserved by the major brands in the category,” Euromonitor beverage analyst, Matthew Barry, said.

However, in many places well-known energy drink brands such as Red Bull are still priced too high to be a realistic option for working-class consumers.

This creates a market opportunity for companies to create value-oriented energy drinks, Barry said.

“The working class is usually priced out and consumption is restricted to groups like wealthy partiers, students at elite schools, and tourists.”

Peru and Colombia see success in lower-priced energy drink

The Aje Group in Peru launched a low-cost Volt energy drink as an affordable option to market leader Red Bull - and it worked.

“It was a smash success, not because most Red Bull drinkers defected to Volt, but because Aje largely created a segment that previously did not exist in Peru: value-oriented energy drink consumers,” Barry said.

Low-priced Volt was being purchased by consumers who never used to buy energy drinks in the first place, he explained. As a result, Red Bull volume share in Peru fell from 80% in 2011 to 16% in 2016, according to Euromonitor.

Colombia had a similar experience seeing a noticeable drop in unit price of energy drinks, with the launch of Quala SA Vive 100, an energy drink targeting the low-to-middle class income segment. The brand now holds a 67% market share by volume, according to Euromonitor.

Egypt ripe for value-oriented energy drinks

Countries that could experience a similar level of success as Peru and Colombia are ones that have limited brand selection with a higher-income consumer base, according to Barry.

“Such markets contain large amounts of people who could benefit from energy drinks, but are unaware of them or view them as irrelevant to people of their social class,” he said.

One developing market on the cusp of breaking into the value-oriented energy drinks and worth keeping an eye on is Egypt where Red Bull dominates the market and per capita consumption remains very low at roughly 0.2 liters per capita.

“The young and wealthy represent virtually the totality of current consumption,” Barry said. “The income structure of Egypt, however, is relatively similar to that of Colombia, suggesting that Egypt may also have a large number of potential energy drink consumers who simply do not view the category as relevant to them at the moment.”