AMP Energy launches organic energy drinks answering consumer call for simpler ingredients

“AMP Energy Organic is the culmination of a multi-year work stream to better meet the emerging needs and desires of an evolving energy consumer,” PepsiCo marketing director of flavors and energy, Justin Schwarz, said.

“We will provide consumers with an alternative to obtain the energy they need through the organic ingredients we know they want.”

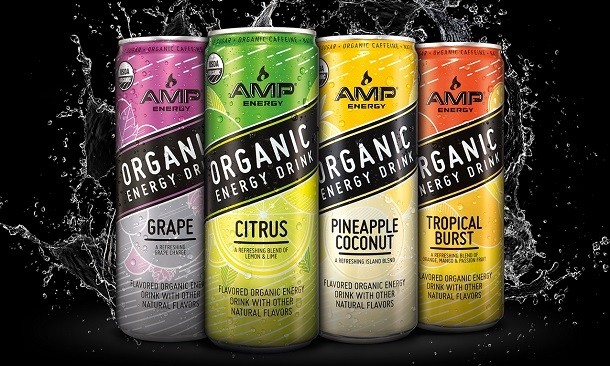

AMP Energy Organic will come in a newly-designed 12-ounce can available in four flavors, citrus, pineapple coconut, grape, and “tropical burst”, made from five ingredients: organic cane sugar, organic caffeine from green coffee beans, carbonated water, citric acid, and natural flavors.

AMP Energy debuted 16 years ago and was originally distributed under PepsiCo’s Mountain Dew brand. AMP Energy Original ingredients include high fructose corn syrup, taurine, B-vitamins, guarana, ginseng, and caffeine.

Sold exclusively at 7-Eleven stores throughout the US, the line of organic energy drinks will be priced at $1.99 per can and for a promotional price of two cans for $3. The beverages will also be promoted via digital and social channels as part of the brand’s “Organically Unstoppable” campaign.

Are energy drinkers health conscious?

Global sales of energy drinks are projected to reach US$63.4bn by 2020 with the US representing the largest market share with nearly US$15bn in 2015, according to Euromonitor.

“The energy drinks category remains fairly vibrant in the United States, although growth is certainly not what it used to be,” Euromonitor beverages analyst, Matthew Barry, told BeverageDaily.

This slowdown in growth is possibly due to negative stories linking energy drinks consumption to cardiac complications and other adverse health effects.

However, this has not caused an exodus by the category’s core demographic being young men ranging from teenagers to millennials, according to Barry.

“Most of them [young male consumers] are already well aware that these drinks aren’t good for them and are drinking them anyway,” he said.

“I think there are probably a pretty large number of them who are paying more attention to what they are putting in their bodies than they used to,” Barry added.

“That does not necessarily mean that they will drink AMP Organic, of course, but the potential is there.”