Danone+WhiteWave reaction

Frost & Sullivan: ‘More dairy companies will expand into the dairy alternative category to offset flat liquid milk sales’

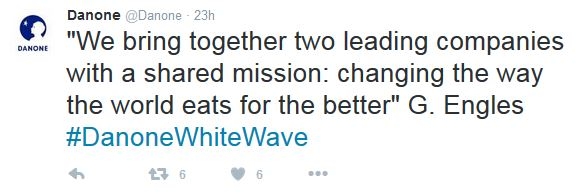

The announcement comes following news Danone will acquire WhiteWave Foods Company (WhiteWave) for approximately $12.5bn, with the transaction expected to close at the end of the year.

Health & Wellness Mega Trend

WhiteWave generated $4bn in sales in 2015 and has a portfolio of brands in North America and Europe in high-growth, on-trend food and beverage categories that focus on premium organic dairy, non-GMO, plant-based alternatives to milk and yogurt, fresh foods, and coffee creamers.

Its business includes Silk, So Delicious, Vega, Alpro, Provamel, Horizon Organic, Wallaby Organic, Earthbound Farm and International Delight.

Christopher Shanahan, global program manager, Visionary Science, Frost & Sullivan, told DairyReporter, though at first seemingly counter-intuitive, it does make sense Danone would want to bring WhiteWave into their fold.

“Both companies are hyper-focused on the Health & Wellness mega-trend and targeting consumers interesting in enhancing their health and well-being, which suggests the pair will make a good match,” he said.

“Also, the target consumer markets for Danone's products are different from WhiteWave's target consumers who tend to be either sensitive to dairy products or tend to be vegetarians/vegans, so very little sales cannibalization will occur.

“With respect to the concerns with increased industry consolidation, the Danone+WhiteWave marriage will not face many regulatory barriers, especially in the US. There is still plenty of competition in terms of private label producers of both milk alternatives and yogurts and other global players like Nestlé who are moving toward dairy alternative products.

“In fact, I would expect to see other dairy companies look to expand into the dairy alternative category to offset flat liquid milk sales and take advantage of the +15% compound annual growth rate witnessed by the plant based dairy alternative category.”

Nick Mockett, head of Packaging M&A, Moorgate Capital, added the growth in organic food is a stated driver for this transaction and it will be interesting to see how this fares in the event of a global economic slowdown.

“Consumers may switch back to lower cost options. Danone already enjoys strong market positions in certain dairy product markets in the US but the organic market angle may allay potential concerns from anti-trust authorities,” he said.

Nestlé 'to pick up activity outside the EU and in the US'

In regards to Nestlé, Tom Pirko, MD, BEVMARK which researches, analyzes and advises on the dairy segment, said, "We are observing a “post-Brexit” moment for M&A as European companies look more to the world rather than focusing on Europe (and the UK) as intently as a market. We expect Nestlé as well to pick up activity outside the EU and in the US."

“Danone’s acquisition of WhiteWave was anticipated. The beverage business, like all other consumer segments at the moment, is being driven by consolidation. To be an international player and move more deeply into the emerging markets, you must exhibit critical mass. Now’s a good time to buy, as soft economies are making prices right,” he said.

“The dairy category is an expanding province, in part due to the pullback from carbonated soft drinks, not only in developed but also emerging markets.

“Consumers are searching for alternatives, particularly healthy alternatives. Consequently, WhiteWave, since the spin off from Dean Foods, has been a major prize. We have watched as both PepsiCo and Coca-Cola edge further into dairy, but it is Danone, for whom dairy is ground zero, that the deal was to be made.

“This mollifies some of the China issues for Danone and shifts priority to the richest market, North America. Not taking this prize would have meant a diminution of Danone; so this was a strategic move, we think for Danone a good one.”

Cashew milk and mixed blends

Pirko added monopolies, while very difficult to win, are heaven for companies in world industries. Oligopolies, however, can be achieved in some cases if global players can achieve deep penetration and distribution with their trademarks.

“It’s all a matter of resources and investment. See the beer business and AB InBev SABMiller. Regulation and antitrust? Complicated… Fair competition, product availability, innovation and most of all, prices for consumers remain seminal issues. The big will get bigger, in the process consuming more and more of the small. Perhaps Darwin was our first management theorist.”

According to Tanvi Savara, consumer insight analyst, Canadean, the reason for WhiteWave’s brand Silk's success has been its strong focus on adopting a "consumer-centric" approach to new product development.

“Consumers are turning to non-dairy products for a multitude of reasons, be they medical or as part of a healthier lifestyle. Silk's range of plant-based products has wide appeal,” Savara said.

“The brand differentiates itself by identifying new consumption occasions for its products (e.g. using its dairy-free yogurt to make smoothies) and expanding its product range to offer a wider variety of options such as cashew milk and mixed blends.”

Savara added consumers opting for dairy and lactose-free brands believe these products offer a healthier alternative to improving their overall digestive health and managing weight.

“According to our global consumer survey results, 23% of consumers avoiding dairy claim to always avoid certain food/drink for allergy or intolerance reasons and a third of people avoiding dairy claim to make a conscious attempt to eat healthily,” she said.