Constellation Brands to pay $1bn to purchase Ballast Point Brewery

The company, one of the largest US beer distributors which imports Modelo and Corona into the US, said this partnership with Ballast Point will give them a “high-growth premium platform that will enable Constellation to compete in the fast-growing craft beer segment.” The deal is expected to close by the end of 2015.

The San Diego-based Ballast Point, which was founded in 1996, is one of the fastest growing craft beer companies in the US and has been gaining in popularity with its Sculpin IPA and Grapefruit Sculpin IPA.

The company is on pace to sell 4 million cases of beer for 2015, a 100% growth from the previous years. Its net sales are slated to reach $115m. This means the deal will be worth nearly nine-times the company’s value.

Stand-alone, but with more pow

The company will continue operations as a stand-alone company with existing management and employees. The company will now have access to the financial strength of Constellation, a company which is seemingly very interested in investing in growth.

"We started this business nearly 20 years ago with a vision to produce great beer that consumers love and to do it the right way," said Jack White, founder of Ballast Point Brewing & Spirits. "To achieve that vision, we needed to find the right partner. The team at Constellation shares our values, entrepreneurial spirit and passion for beer, and has a proven track record of helping successful premium brands reach the next level of growth and scale."

Rob Sands, CEO of Constellation Brands, said craft beer is a key driver of growth in the beer industry. The company is trying to strengthen its position in the “high-end beer segment,” he said, with what he calls the “arguably the most premium major brand in the entire craft beer business."

2015 craft deals include:

SABMiller acquires London’s Meantime Brewing Company (May)

Heineken takes 50% stake in Chicago’s Lagunitas (September)

AB InBev buys Golden Road Brewing in Los Angeles (September)

Constellation Brands predicts that this acquisition will mean neutral to diluted earnings per share for fiscal year 2016 and $0.05 to $0.06 accretive for fiscal year 2017.

Craft beer market on the rise

Mintel estimates that the craft beer market will grow 22% to $24bn by the end of 2015. Consumption is up roughly 5% since 2011, the company’s craft beer report said, with the growth in large part due to an expansion of offerings and purchasing channels.

The investment in craft beer, which includes Heineken’s purchase of Lagunita’s earlier this year, makes sense when looking at Mintel’s predictions for the craft beer market. The company’s best case scenario for the craft beer market in 2020 has it ascending to $52bn. While the market may not double, it almost certainly will grow handsomely, as Mintel's realistic prediction is that the market will reach $38bn by 2020.

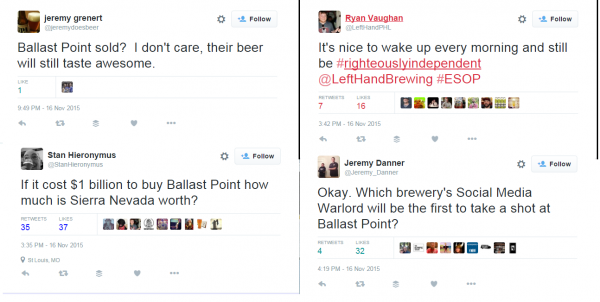

Below, read some reactions from Twitter, including Lagunita's Brewing's Jeremy Grenert and Left Hand Brewing's Ryan Vaughan, among others.